Content

Likewise, the error can go on to affect the total amount of profit generated as well as the income tax return. Notice that purchases and production might not be the same throughout the year, since purchase cost and production cost might vary.

In this case, the total cost of goods sold for the year would be $110,000. The store’s gross margin for the period would be equal to $135,000 ($60,000 + $225,000 – $40,000 – $110,000). Now, let’s say that over the ensuing year, the store owners purchase $100,000 of additional inventory, Cost of goods available for sale with a total retail value of $225,000. And, at the end of the year, the store has a remaining inventory worth $40,000, which had cost $20,000 to acquire. Cost of goods sold expresses how much businesses had to invest in inventory they ultimately sold throughout a certain period.

Using cost of goods sold to improve profitability

It is different from the cost of goods sold which looks at what you have already sold to your customers. You use the cost of goods available for sale formula to help calculate the cost of goods sold, which you will eventually use to calculate the profit that your company is making.

- Likewise, the error can go on to affect the total amount of profit generated as well as the income tax return.

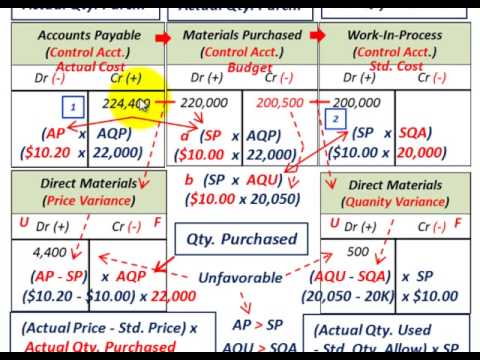

- However, the calculation carried out by manufacturers is slightly different.

- The inventory has a retail value of $60,000 and costs the store owners $30,000 to acquire.

- Build models effortlessly, connect them directly to your data, and share them with interactive dashboards and beautiful visuals.

- Instead, they have what is called “cost of services,” which does not count towards a COGS deduction.

- The first thing you need to realize is that COGS are critical in determining the operational efficiency of your business.

You can enter your COGS and the cost of each SKU, which will then automatically calculate your profitability analysis. Since https://online-accounting.net/ this method isn’t affected by purchase or production date, the COGS is less likely to be impacted by cost fluctuations.

Cost of goods sold formula

COGS reveals for business owners and managers the total direct costs of their products or services sold over a certain period. This allows companies to calculate their gross profit margin on sales made during a period and is one step towards determining the company’s net profit. Costs of revenueexist for ongoing contract services that can include raw materials, direct labor, shipping costs, and commissions paid to sales employees. These items cannot be claimed as COGS without a physically produced product to sell, however. The IRS website even lists some examples of “personal service businesses” that do not calculate COGS on their income statements.

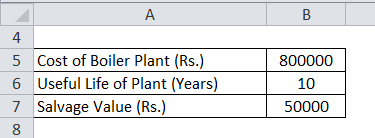

Is cost of goods available for sale debit or credit?

You may be wondering, Is cost of goods sold a debit or credit? When adding a COGS journal entry, debit your COGS Expense account and credit your Purchases and Inventory accounts. Inventory is the difference between your COGS Expense and Purchases accounts.

The balance sheet has an account called the current assets account. The balance sheet only captures a company’s financial health at the end of an accounting period.