Contents:

Over the long run, the stock market is one of the best places to put your money to work. Trading platform includes more than 100 chart studies and drawing tools to help active traders identify their next move. If you become a preferred client of the broker, you’ll receive access to detailed research reports on individual stocks, but you can receive research from Morningstar and Lipper, too. If you are looking to trade often, E-Trade’s discounts on volume options trading are a huge benefit. Brian Beers is the managing editor for the Wealth team at Bankrate.

What are the three types of brokerage?

- Full-service broker. A full-service broker provides a large variety of services to its clients.

- Discount brokers.

- Robo-advisers.

With others, you may have no communication at all with an investment professional. However, most provide educational resources so you can make an informed decision. A discount broker is a stockbroker who performs buy and sell orders at a reduced commission rate. Transactions costs are the prices paid to trade a security, such as a broker’s fee and spreads, or to make any trade in a market. Brokers may work for brokerage companies or operate as independent agents.

Discount vs. Full-Service vs. Internet Brokerages

The AIM exchange is specifically intended for smaller companies seeking their first listing. The companies can be based anywhere in the world and operate in any sector. The listing requirements are more modest than for the main exchange and the fees less expensive. On their web site, you will find a list of qualified advisors and brokers allowed to bring companies to market on AIM.

- Our team of experts has compiled a list of the best trading platforms and what you should look for when comparing brokers.

- Brokerage assets are held by Vanguard Brokerage Services, a division of Vanguard Marketing Corporation, member FINRA and SIPC.

- If you’re new to investing, consider choosing an online broker that offers educational resources — many have libraries of how-to content on their websites to help you get started.

- To buy a stock, you used to have to call an individual known as a stock broker, who placed the order on your behalf.

For example, discount stockbrokers manage trades and take a low commission on the deal, but they cannot provide financial or investment advice due to having different licensing and registration. If that’s the case, you’ll have to wait until the broker deposits a small sum in your bank account — typically a few cents. Then you’ll confirm the transaction by telling the brokerage the exact amount that was deposited. If you have any questions, the broker can walk you through the process.

Best online brokers for stock trading in April 2023

It simply provides a service to the financial market, which generates its primary source of income. A brokerage account allows an investor to deposit funds with a licensed brokerage firm and then buy, hold, and sell a wide variety of investment securities. In the past, only wealthy people used a broker for stock market trading. Online brokers allow investors to trade at considerably lower costs compared to their pre-Internet counterparts.

To find the best online broker for you, look for discount brokers that require a low minimum investment and charge no ongoing account fees. If you’re new to investing, consider choosing an online broker that offers educational resources — many have libraries of how-to content on their websites to help you get started. They not only execute trades for you, but also provide a range of other services, which might include tax planning, research, investment advice, and estate and retirement planning. A full-service brokerage will typically have a dedicated broker who can meet with you in person and provide personalized advice based on your specific circumstances. There are different kinds of brokerage services offered by different types of brokerage firms.

If you are a brand-new what is a brokerage companyor and only want to invest a few hundred dollars at first, you’ll probably want to look for a broker with no minimum investment requirement. If you plan to simply buy and hold stocks, you probably don’t need a full-featured trading platform. Webull is a mobile-first investing platform that stands out with the quality and simplicity of its experience and no commissions.

The best online brokers for stocks in 2023:

Choices might include nonretirement accounts, retirement accounts, college savings accounts and health savings accounts. When it comes to choosing the right type for you, consider what services you need to have access to. If you need professional financial consulting, then a full-service brokerage firm will better suit your needs. But if you don’t need any consulting and can do everything online, then an online brokerage firm will fit your needs. Stockbrokers are regulated professionals, usually working with a broker-dealer or brokerage firm.

Brokerage firms are distinguished from traditional banks by the way they allow customers to buy and sell securities. Investors wishing to open broker accounts need to consider their trading needs and interests to properly select their brokers. Investors needing substantial advice and counsel along with other services may find their needs better fulfilled by full-service brokers such as Merrill Lynch, Raymond James, or UBS.

Stock market today: Dow rides banks to close higher, shrugging off … – Investing.com

Stock market today: Dow rides banks to close higher, shrugging off ….

Posted: Mon, 17 Apr 2023 20:27:00 GMT [source]

A robo-advisor is an app or website that creates an investment portfolio for you based on your financial goals. You typically don’t interact with a person — everything is automated. Since few people are involved, the fees are typically very low. Understand what a brokerage firm or company is by learning a definition.

Fee Schedule

Full-service brokerages often take an active, hands-on role in managing all of a person’s assets, and provide significant financial planning. Where insurance is concerned, a broker is also the term for one who sells insurance. Like the brokers at a brokerage firm, these insurance professionals earn a commission from every insurance policy they sell.

This firm can also buy and sell securities on behalf of clients. The services offered by brokerage firms are in exchange for a fee or commission. An individual can also act as a broker who helps to facilitate transactions between parties. In some cases, brokerage companies are investment firms or financial institutions that perform the duties of a broker in a transaction. These companies either act as middlemen or act in the best interest of the client they are representing. In the actual sense, individuals act as brokers whether in the real estate or investment industry.

We are an independent, advertising-supported comparison service. Brokers of all types must show a strong mix of hard and soft skills. Often through licensing courses and on-the-job training, brokers learn the hard skills needed to do their job well. These skills include being able to use sales platforms and understanding specific documents they’ll use in their job. Some robo-advisers are now employing human advisors who can engage with customers.

These dealers and firms buy and sell stocks and other financial securities. For example, licensed real estate brokers may advertise properties for sale and show them to prospective purchasers. They also determine the properties’ market value andadvise their clients regarding offers and other related matters. Most fundamental was the lack of a legal basis for stock brokerage firms independent of banks. There are many brokerage business model types in the B2B and B2C space.

Regulatory agencies such as the Securities and Exchange Commission and Commodity Futures Trading Commission provide useful alerts and bulletins that are worth checking. One of the common misconceptions about investing is that investments always have positive returns, i.e., if you invest, you will earn money at all times. This belief might be true on average, measured as a cumulative return over many years. However, the performance of an investment portfolio could be volatile, i.e., experiencing both negative and positive returns periodically. Another misconception about investing is that anyone who invests in financial markets will become rich quickly.

Mortgage Broker

The use of any illegal drugs are not permitted and will cause immediate termination of association with the Brokerage company. Get advice on achieving your financial goals and stay up to date on the day’s top financial stories. Real estate is often thought of as a “safe” investment because prices tend to trend upward over the years. As a member, you’ll also get unlimited access to over 88,000 lessons in math, English, science, history, and more. Plus, get practice tests, quizzes, and personalized coaching to help you succeed.

A customs broker also provides information to importers and exporters to better understand what the requirements are and what clearances may be required. Helping you navigate the world of insurance by bringing you expert advice and all the current information you need to make the best insurance decisions for you, your family and your business. Your website access and usage is governed by the applicable Terms of Use & Privacy Policy. You can also look at the site called Morningstar that rates your fund and compare it to others in the same investment category. Nicole Madison Nicole’s thirst for knowledge inspired her to become a SmartCapitalMind writer, and she focuses primarily on topics such as homeschooling, parenting, health, science, and business. When not writing or spending time with her four children, Nicole enjoys reading, camping, and going to the beach.

- Financial planners often recommend, first and foremost, to contribute at least enough to a company’s 401 plan to earn the company’s match, if that’s a possibility.

- Upon approval of the application by the CEO of Pakistan Stock Exchange, a Certificate is issued to the respective applicant.

- However, there is no such thing as perfect information, asymmetric knowledge, or opacity in reality.

- Build your confidence with hundreds of exam questions with hints, tips and instant feedback.

Some of the more common include the buy/sell match model, buyer-aggregator model, classified-advertiser model, virtual mall model, auction and reverse auction model, and directory and evaluator model. You can use your brokerage account to gain access to stocks and other types of investments. Opening a brokerage account is one of the first steps to building your personal investment portfolio. Founded in 2007, eToro is a commission-free trading platform with a worldwide presence (+140 countries) and 30 million registered users. It is a multi-asset brokerage company offering stocks, ETFs, and thousands of CFD products on stocks, indices, currencies, and commodities.

A more bespoke version of the virtual mall model, where the broker locates multiple product suppliers and sells their products in a single online store sorted by department. For example, the online classified platform Craigslist charges users for brokering sales of apartments, commercial real estate, cars, trucks, and furniture. This model is routinely used by financial brokers, insurance brokers, travel agents, and brick-and-mortar businesses with an online presence. Brokerage businesses usually charge a commission or fee to one or both parties in exchange for services rendered.

Westland Insurance Group announces new capital partnership with … – GlobeNewswire

Westland Insurance Group announces new capital partnership with ….

Posted: Mon, 17 Apr 2023 16:46:34 GMT [source]

However, you’ll often pay a lower brokerage fee for this service — typically a flat, per-trade fee. A brokerage commission house is a company that buys and sells stocks, bonds, and other assets in return for payment from a client, a sponsor, or both. A registered representative is a financial professional who works with clients who are trading investments such as stocks and bonds. Independent brokerages are not affiliated with a mutual fund company. They may be able to recommend and sell products that are better for the client. A robo-advisor is an online investment platform that uses algorithms to implement trading strategies on behalf of its clients in an automated process.

No matter what type of brokerage company you choose to use, expect to pay fees at some point in time. While it’s true that today’s retail trading environment offers a low-to-no fee structure, most brokerages still charge for certain products and services. Get to know your broker’s fee structure before executing any trades—both to avoid surprises and to cut down on costs.

How does a brokerage make money?

How does a broker make money? Brokers are typically compensated through a commission on each trade. Investors have historically paid a broker a commission to buy or sell a stock.

A https://trading-market.org/ firm operates as a go-between, bringing buyers and sellers together to complete a transaction. Brokerage firms usually are compensated by commissions or fees charged after a transaction has been completed successfully. In fact, many brokerage firms allow you to open an account with no up-front deposit.

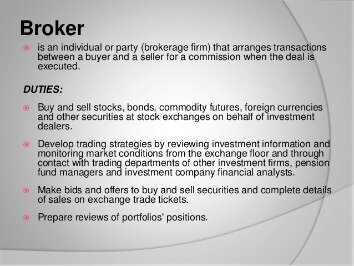

What is the role of brokers company?

The vital role of a brokerage company is to act as an intermediary, connecting buyers and sellers to allow for a transaction. Brokerage firms can receive payment through a commission (either a flat fee or a percentage of the transaction amount) once the transaction is completed successfully.